Department News

WEEK ENDING 17/05/2024

Check out the latest and greatest updates for OC below.

People & Culture

Update | May 2024

Recruitment:

We are hiring!

Reception & Administration Officer

2024 Quiz Night

Save the Date for our 2024 Quiz Night! Invite your friends and family along to a night that promises loads of laughs, plus raises money for a great cause!

Tickets on sale NOW! >> Click Here

Massage Day

The wonderful team from Working Hands Corporate Massage will be visiting the Eastwood, Henley and Lonsdale Offices once again next week! They have provided a simple ‘self-booking’ service so that you can book yourself in for a 15-minute seated massage at a time & location that suits you.

Henley Office – Tuesday 21st May 2024 from 10:00am – 2:00pm

https://workinghands.as.me/OCREHenley

Eastwood Office – Tuesday 21st May 2024 from 10:00am – 4:30pm

Meeting Room 1 – https://workinghands.as.me/OCREEastwoodRm1

Meeting Room 2 – https://workinghands.as.me/OCREEastwoodRm2

Lonsdale Office – Thursday 23rd May from 12:30pm – 4:30pm

https://workinghands.as.me/OCRELonsdale

REI Super

A big thank you to Chris for visiting OC during our Sales Meeting last week. See the attached flyers (also accessible on The Hub) for more information on REI Super:

REI Super Health Check flyer

REI Super Work in Real Estate flyer

REI Super Member brochure

Oscar Hunt – Winter Offer

OC Real Estate

The Numbers | May 2024

OC Projects

Update | May 2024

JUST LAUNCHED // Verde in Athelstone

Bringing you uniquely designed residences within a private sanctuary.

Verde in Athelstone is situated amongst an array of greenery. The area’s history is that of industrious market gardens and a welcoming multicultural community which, generations later, is still thriving.

Thoughtfully considerate of the surrounding nature and close to some of Adelaide’s best lifestyle amenities, these 19 tastefully designed homes will provide effortless living and convenience in a peaceful setting.

Learn more >> Verde in Athelstone – Bringing you uniquely designed residences within a private sanctuary.

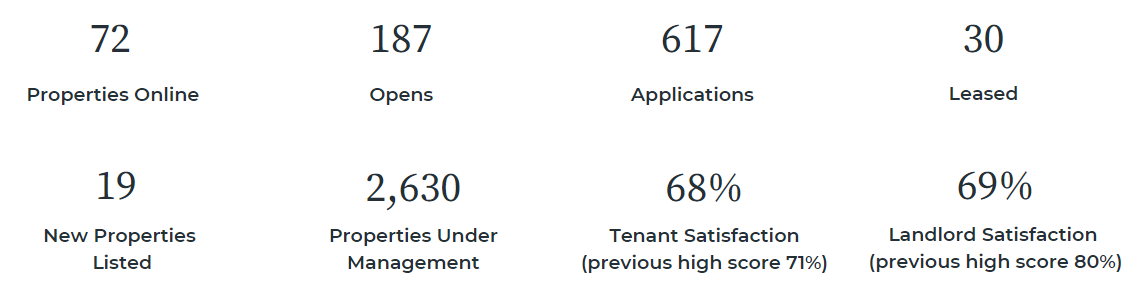

Property Management

The Numbers | May 2024

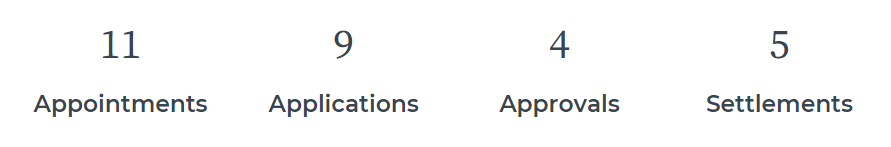

Fresh Home Loans

The Numbers | May 2024

Update

It was the event of the season and I’m not talking MET Gala or Eurovision: The 2024-2025 National Budget was announced on Tuesday evening, and like many of you I was propped in front of the telly with popcorn waiting in anticipation. No, not you? Just me? Moving on.

The topic of the evening was inflation. How do we hand out money to those in need without giving them too much money to spend causing inflation to spike thus giving the RBA a reason to increase the cash rate thus p***ing off all (and soon-to-be) mortgage holders in Australia who will be casting their votes at the polls in the not-too-distant future?

You get $300 and You get $300, and YOU get $300! Everyone gets $300… off their electricity bill!

Let’s dig a bit deeper around how it relates to helping people realise their hopes and dreams through property.

- It is estimated the government will be putting around $11.3b toward housing as it strives to deliver the promise of 1.2 million new homes by 2030.

- An increase in the maximum rates of Commonwealth Rent Assistance by a further 10%

- More access to finance for community housing providers through the Affordable Housing Bond Aggregator

- $1b for crisis and transitional accommodation for vulnerable groups

- $1b to states and territories for infrastructure supporting new homes and social housing

- A five-year National Agreement on social housing and homelessness

- $90.6m to boost the number of construction workers and provide 20,000 additional fee-free TAFE training places.

In addition:

- The stage 3 tax cuts will offer a higher take-home wage for most Australians therefore increasing borrowing capacity.

- Changes to annual HECS indexation means the debt could be paid off sooner and although that might not be in time to help first home buyers, it could certainly help those looking to invest in property.

A first home buyer earning $75k per annum is anticipated to receive a tax cut of around $1,554 which could increase their borrowing capacity by $10,000 and this could be the difference between just missing out or winning the next auction.

While the RBA predicted that inflation would reduce to 3.2% by June next year, old mate Jim reckons it will be closer to 2.75% by then and the short story is that either way, both figures point to inflation heading in the right direction without the need for another rate hike. Rates are likely to remain on hold but for how long? If the Government’s plan (budget) works, then we’ll have a rate cut by Christmas and Jim Chalmers will be thanking the treasury gods that their gamble paid off.